👍🏻 Best Retirement Plans In Singapore 2021

These are the best retirement annuity plans in the market for 2021

In this article, we take a look at the best retirement annuity plans in Singapore. Read this now and plan for your retirement with confidence.

With so many retirement annuity plans in the market, it can be rather difficult to find one that is best suited for your retirement goals.

In this article, we have filtered through all the retirement annuity policies to bring you the best retirement plans in Singapore as of 2021.

From disability benefits to retrenchment benefits, you can be sure to find one that suits your retirement planning needs.

We have also created real-life examples of what you can expect from each retirement plan. The following examples are built upon these bases:

- Age 40 when purchasing the retirement plan

- Pay premiums for 10 years only

- Retirement age at 65

- Receive 20 years of monthly retirement income

- Guaranteed monthly income of S$1,500

Aviva MyRetirementChoice II – Best Retirement Plan for Flexibility in Retirement Age and Payout Term

What you may look forward to:

- Flexible choice of premium terms from 5 to 25 years (5-year intervals)

- Flexible choice of payout period from 5 to 35 years

- Upon reaching your selected retirement age, you can choose to receive a bonus or convert it to AMI (Additional Monthly Income)

- Disability benefit; receive up to 2x the guaranteed monthly income in the event of Total and Permanent Disability (TPD)

- Fast Forward Option allows you to receive the disability benefit in a lump-sum

- Future premiums are waived in the event of TPD

- Wide range of premium waiver riders available

What you may not look forward to:

- The guaranteed yield was higher in the previous version of the plan

- You cannot fund this retirement plan using your SRS

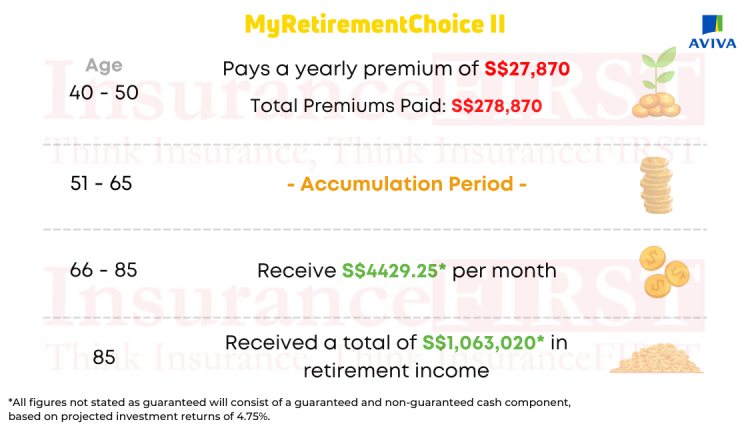

Real-Life Example of Aviva MyRetirementChoice II

John, 40, chooses to buy Aviva MyRetirementChoice II to plan for his retirement. He pays a yearly premium of S$27,870 for 10 years.

With a total of S$278,870 paid, John chooses a retirement age of 65, allowing his premiums to accumulate value until then.

At age 66, John will reach his chosen retirement age and will begin receiving monthly retirement income. He chooses to convert the retirement bonus into additional monthly income, boosting his monthly retirement income to S$4429.25 non-guaranteed plus guaranteed.

By the age of 85, John would’ve received S$1,063,020 in total projected retirement income, a grand 381% return on his investments which would have otherwise not been possible if the premiums he paid were instead left sitting in the bank.

AIA Retirement Saver III – Best Retirement Plan for Cash Maturity Benefit

What you may look forward to:

- Lump-sum premium payment option available

- Flexible premiums terms of 5 to 20 years (5-year intervals)

- Flexible retirement age of 55 to 70 to start receiving monthly income (5-year intervals)

- High illustrated yield up to 4.70% per annum

- Terminal bonus; receive non-guaranteed bonuses upon policy maturity, surrender or claim

- You can fund this retirement plan from AIA using your SRS

- Critical Illness premium waivers available

What you may not look forward to:

- The terminal bonus is only given upon policy maturity, surrender, or claim. If you prefer a higher monthly income and have no need for a lump-sum upon policy termination then this may not be for you

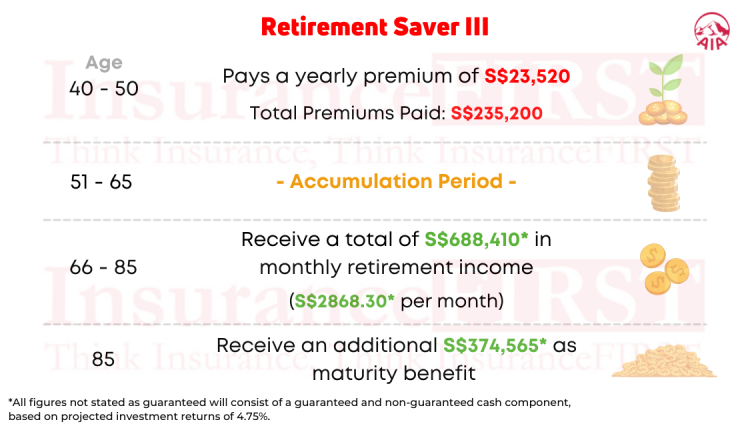

Real-Life Example of AIA Retirement Saver III

Candy, age 40, purchased AIA Retirement Saver III to save for her ideal retirement plan. She pays a yearly premium of S$23,520 for the next 10 years.

Candy’s retirement plan then enters into the accumulation period with a total of S$235,200 paid in premiums.

Here’s where things are different for AIA Retirement Saver III compared to the other plans listed here.

For simplicity’s sake, the diagram above says that from age 66, Candy receive S$2868.30 per month. However, that was just the average monthly income. The non-guaranteed part of her monthly income rises after the 5th and 10th year, and on the last year. This means that Candy will only receive a total of S$2322.50 per month from the 1st to the 4th year, but receive S$3597.50 per month by the last year. This is not including the maturity bonus.

On average, Candy is set to receive an average of S$2,868.30 per month which makes a total retirement income of S$688,410 for the whole 20-year payout period.

Candy, now age 85, receives a maturity bonus of S$374,565 which she had planned to give to her grandchildren as an inheritance.

All in all, AIA Retirement Saver III gave Candy a good 451% return on her investment.

Manulife RetireReady Plus II – Best Retirement Plan for Retrenchment Benefit

What you may look forward to:

- Flexible choice of premium terms (single premium or 5 to 20 years)

- Flexible choice of retirement age 50 to 70

- You can choose to receive retirement income for 5 to 20 years or for a Lifetime

- Receive a bonus upon reaching the retirement age or choose to convert to AMI

- Disability benefit; receive up to 2x the Guaranteed Monthly Income of TPD

- You can choose to pause premium payment for a year if the need arises

- Retrenchment benefit; receive a lump-sum cash benefit in the event of retrenchment

- Fundable with SRS

What you may not look forward to:

- Your initial monthly income will be low if you chose the lifetime income payout option

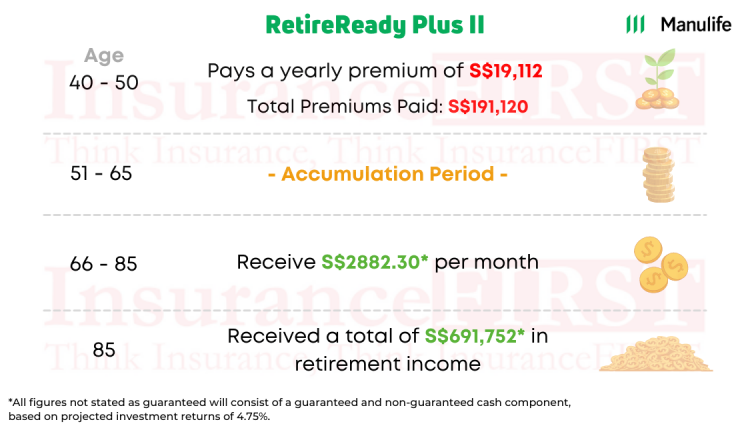

Real-Life Example of Manulife RetireReady Plus II

James, at age 40, purchases Manulife RetireReady Plus II to plan for his retirement. He pays a yearly premium of S$19,112 for the next 10 years.

At the same time, James is covered with the retrenchment benefit. In the event James is retrenched for more than 30 days during the premium payment term, he will receive S$7,644.60 in a lump-sum retrenchment payout to help him tide through.

With a total premium paid of S$191,120, Jame’s retirement policy then enters its accumulation period for the next 15 years.

Upon reaching age 66, James is set to receive S$2882.30 per month for the next 20 years.

James would have collected a total of S$691,752 in total projected retirement income by the time he is age 85, giving him a good 362% return on his investment.

NTUC Income Gro Retire Ease – Best Retirement Plan for Disability Benefit

What you may look forward to:

- A guaranteed yield of up to 2.70% per annum

- Flexible premium terms of 5 or 10 years or up till 5 years before the end of the accumulation period. The accumulation period starts the moment you buy the policy until your chosen retirement age

- You can choose to retire 10 to 15 years after an accumulation period of 10 to 15 years or at age 50, 55, 60 or 65

- You can choose to receive your monthly retirement income over 10, 20 or 30 years after the accumulation period

- Disability benefit; All future premiums are waived and you will receive a lump-sum 6X the monthly income in the event of TPD as well additional 2X the monthly cash benefit upon reaching your retirement age

- Death benefit; Receive 105% of premiums paid and 100% of terminal bonus upon death

- Accidental death benefit; Receive an additional 105% of premiums on top of the death benefit

What you may not look forward to:

- There isn’t a single premium option

- You cannot use your SRS to fund this retirement plan

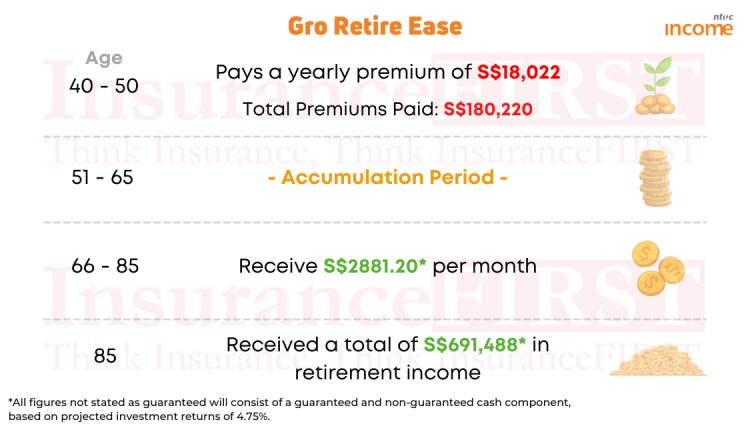

Real-Life Example of NTUC Income Gro Retire Ease

Chloe purchased NTUC Income Gro Retire Ease to plan for her retirement. She pays a yearly premium of S$18,022 for 10 years.

Chloe is then covered by the retirement plan’s disability benefit which seeks to give her a lump-sum of 6X the monthly income in the event of disability during the accumulation period and waiving all future premiums. If disability occurs after the accumulation period, she will receive an additional 1X the monthly income until policy maturity.

From age 66, Chloe starts receiving S$2881.20 per month for the next 20 years in retirement income.

By age 85, Chloe would’ve received a total retirement income of S$691,488, a positive 383% return on her investment

Conclusion

While these are the best retirement annuity plans in the market, they may not be the best for you. Speak with one of our partnered financial advisors to ensure you get the best possible advice for your situation.

Get your quote within 24 hours!

InsuranceFirst.sg compares and bring you the best 3 insurance quotes across all insurers in Singapore. Be it for your savings or protection needs, we got you covered!

Alternatively, drop us a message to know how a retirement annuity plan fits your financial portfolio.