Best Endowment Insurance Plans Singapore 2021

Best Endowment Plans To Maximize Your Savings

Find out what are the best endowment plans in Singapore right now in 2021. This article will help you maximize your savings, safely as possible!

Before we dive into what are the best endowment plans in the market, let’s briefly go through what exactly is an endowment insurance savings plan and how one might play a beneficial role in your financial planning

What is an endowment plan?

An endowment plan is a combination of wealth accumulation and life protection insurance. But more towards the wealth accumulation side.

There are 2 main types of endowment plans. Participating and non-participating endowment plans. For the purpose of simplifying things, we will only be talking about participating endowment plans in this article.

A participating endowment plan invests the premiums you pay in the market, thereby giving you guaranteed and non-guaranteed returns. The non-guaranteed returns are as its name implies, aren’t guaranteed and will vary according to the performance of the investments done by the insurer.

What can an endowment plan help me achieve?

Depending on your goals, the endowment plan will then reach its maturity date. Giving you a lump-sum maturity benefit containing the guaranteed returns and any non-guaranteed bonuses which you can then use to fund your goals.

An endowment plan is a great option for those who want to save for short to long-term goals. From buying a car to getting married to having kids and paying for their university education, there’s a myriad of uses for endowment plans.

Now that we’re clear on what exactly is an endowment plan and how one can help us, let’s find out what actually makes a good endowment plan.

What makes a good endowment plan?

In our mission to filter out the best endowment plans, we take into account the various product benefits, flexibility in the sense of premium and policy terms, and their potential payouts.

Through vigorous filtering, here are our take on the best endowments plans through the dozens in the market:

- Best Endowment Plan for Highest Guaranteed Returns – Aviva MyWealthPlan

- Best Endowment Plan for Yearly Cashback Benefit – Manulife ManuWealth Secure

- Best Endowment Plan for Flexibility (Premium Terms) – NTUC Income Gro Secure Saver

Best Endowment Insurance Savings Plan for Highest Guaranteed Returns – Aviva MyWealthPlan

Aviva’s MyWealthPlan gives the highest guaranteed returns up to 2.35% per annum with a flexible premium and policy term. Multiple riders are available to waive premiums in the event that the unexpected occurs.

What you may look forward to:

- High guaranteed returns of up to 2.35% per annum

- Flexible premium and policy term

- Pay premiums for 5 years and choose a policy term of 10 to 25 years

- Pay premiums for 10 years and choose a policy term of 13 – 25 years

- Various premium waiver riders should the unexpected occur

What you may not look forward to:

- Takes a few more years to breakeven compared to the other 2 products listed here

Riders available:

- Cancer Premium Waiver II – Future premiums are waived if diagnosed with major cancer

- EasyTerm – Receive lump sum cash in the event of Death, TPD, or Terminal Illness

- Easy PayerPremium Waiver – Future premiums of dependants are waived in the event of Death, TPD, or TI

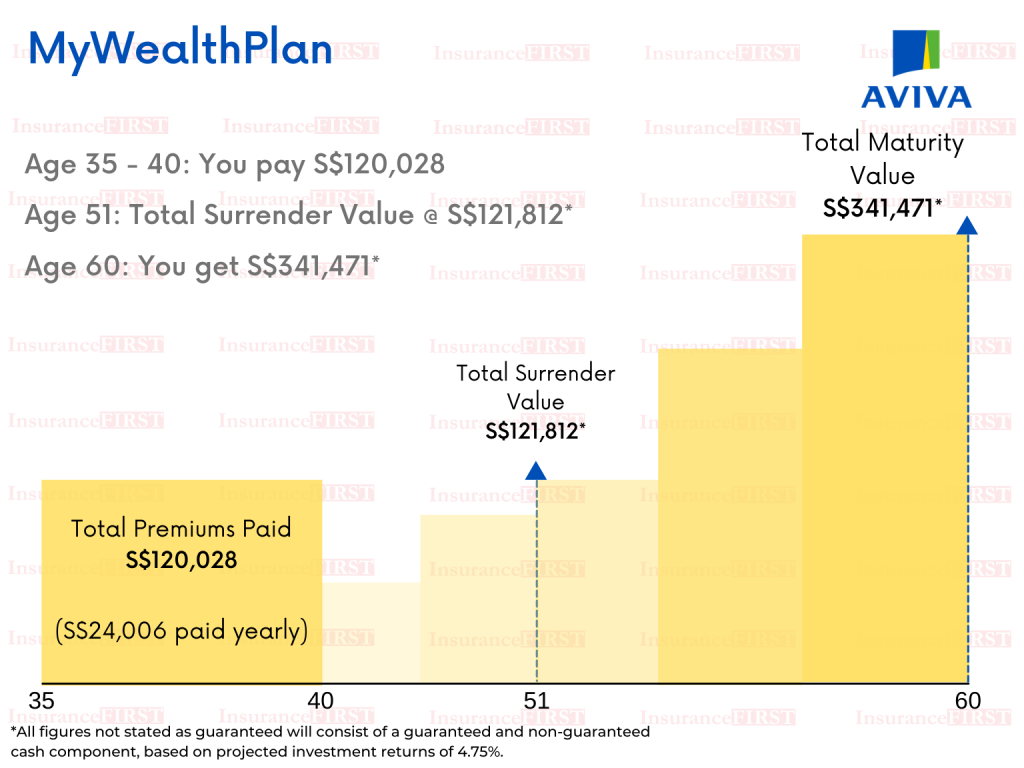

Kenny, upon turning age 35, purchases Aviva MyWealthPlan to save for his future. He chooses a policy term of 25 years with a premium term of 5 years to get the best possible returns from his endowment policy.

Kenny saves a yearly sum of S$24,006 for the next 5 years for his endowment policy.

With a total of S$120,028 paid in premiums. Kenny’s endowment policy breaks even at age 51 with a policy value of S$121,812 which he can decide to surrender or continue keeping the policy to let it accumulate for a higher value.

At age 60, Kenny’s Aviva MyWealthPlan endowment policy reaches maturity and he receives a maturity benefit of S$341,471, finishing his savings journey.

Best Endowment Insurance Savings Plan for Yearly Cashback Benefit – Manulife ManuWealth Secure

Giving you yearly cashback the sum of 5% of the Sum Assured, Manulife’s ManuWealth Secure helps you grow your savings with a short premium term of 3 or 5 years. You have the option to reinvest these cash coupons to accumulate for a higher cash value.

What you may look forward to:

- Yearly cash coupons of 5% of Sum Assured – Withdrawal Benefit (from the end of the premium term)

- Short premium payment term

- Pay 3 or 5 years of premiums for a policy term of 13, 15, 20, or 25 years

- Option to reinvest the yearly coupons to grow your cash value

What you may not look forward to:

- Early surrender of the policy will lead to severe financial loss

- Lower returns compared to the other 2 products listed here

- No premium waiver riders available

Riders available:

- No riders available

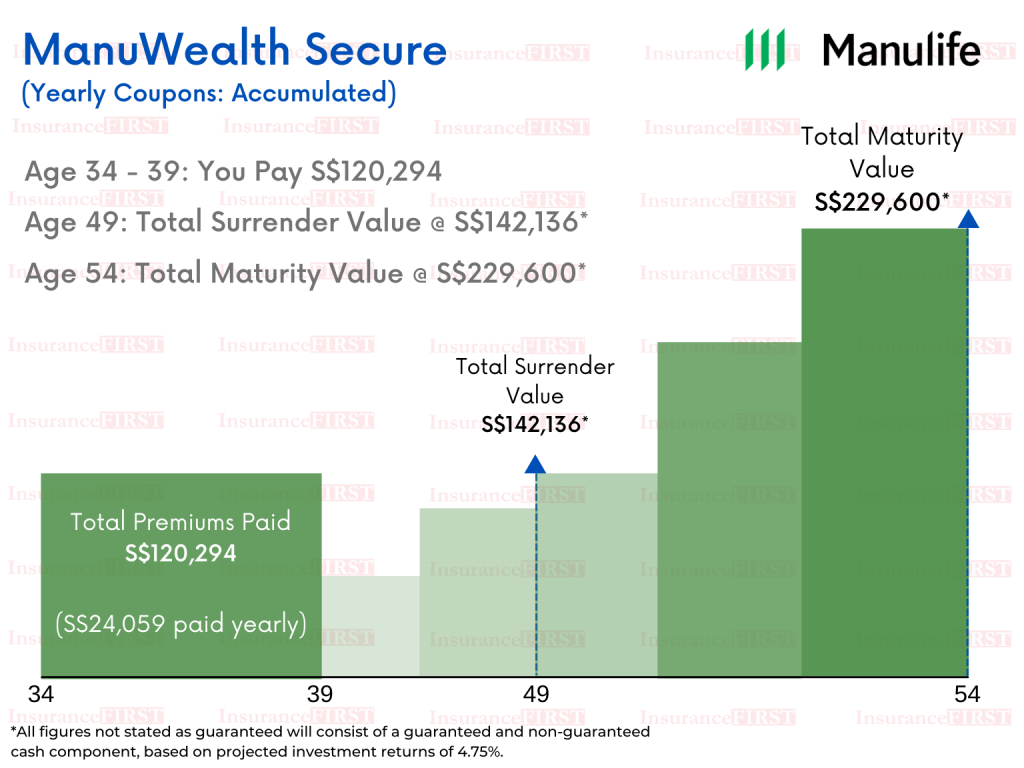

Dawn, upon turning age 34, purchases Aviva MyWealthPlan to save for her future. She chooses a policy term of 20 years with a premium term of 5 years.

Dawn saves a yearly sum of S$24,059 for the next 5 years for her endowment policy.

With a total of S$120,294 paid in premiums. Dawn can start receiving yearly coupons the sum of 5% of the Sum Assured. She instead chooses to reinvest them to accumulate for higher returns.

Dawn’s endowment policy breaks even at age 49 with a policy value of S$142,137 which she can decide to surrender or continue keeping the policy to let it accumulate for a higher value.

At age 54, Dawn’s Manulife ManuWealth Secure endowment policy reaches maturity and she receives a maturity benefit of S$229,600, finishing her savings journey.

Best Endowment Insurance Savings Plan for Premium & Policy Term Flexibility – NTUC Income Gro Secure Saver

NTUC Income’s Gro Secure Saver is for you if you are looking for maximum flexibility with their wide range of premium and policy terms. Enjoy high illustrated yields of up to 4.30% per annum with an accidental death coverage the sum of 100% of the Sum Assured.

What you may look forward to:

- High illustrated yield up to 4.30% per annum

- Flexible premium and policy term

- Pay 5 years and choose a policy term of 10 to 25 years

- Pay 10 years and choose a policy term of 15 to 25 years

- Pay 15 years and choose a policy term of 20 to 25 years

- Accidental death coverage additional 100% of the Sum Assured

What you may not look forward to:

- Rider to waive premiums only cover major cancer

- No withdrawal benefit during the policy term

Riders available:

- Cancer Premium Waiver GIO – Future premiums are waived if diagnosed with major cancer

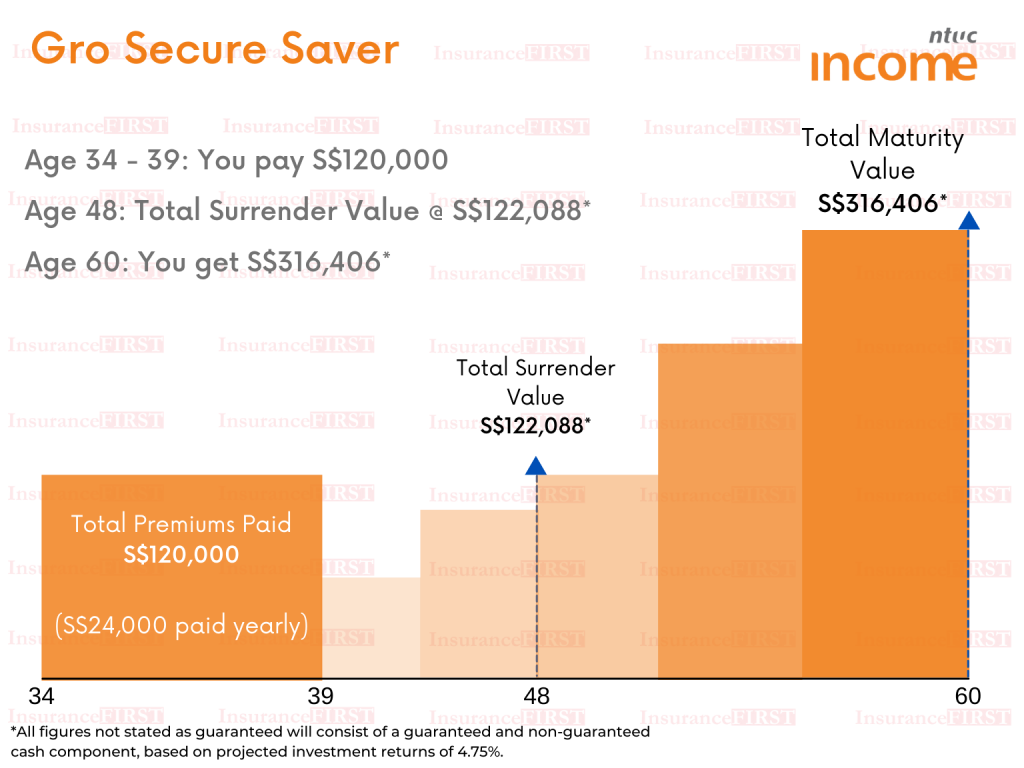

John, upon turning age 34, purchases NTUC Income Gro Secure Saver to save for his future. He chooses a policy term of 25 years with a premium term of 5 years to get the best possible returns from his savings.

John saves a yearly sum of S$24,006 for the next 5 years for his endowment policy. Throughout his savings journey, John is protected against accidental death an additional 100% of the sum assured.

With a total of S$120,000 paid in premiums. John’s endowment policy breaks even at age 48 with a policy value of S$122,088, which he can decide to surrender or continue keeping the policy to let it accumulate for a higher value.

At age 60, John’s NTUC Income Gro Secure Saver endowment policy reaches maturity and he receives a maturity benefit of S$316,406, finishing his savings journey.

Conclusion

While these are the best endowment plans in the market, they may not be the best for you. Speak with one of our partnered financial advisors to ensure you get the best possible advice for your situation.

Get your quote within 24 hours!

InsuranceFirst.sg compares and bring you the best 3 insurance quotes across all insurers in Singapore. Be it for your savings or protection needs, we got you covered!

Alternatively, drop us a message to know how a savings insurance fits your financial portfolio.