Manulife Ready CompleteCare – Get up to 900% of coverage amount.

Manulife Ready CompleteCare restarts your coverage over and over again up to 900% of your sum insured, even after you’ve made a claim.

Manulife Ready CompleteCare review – Get the highest critical illness coverage across all stage of CI in Singapore. Additional benefits include complimentary health check and free coverage for your child.

Nothing about a critical illness is ever easy, especially financing it. Manulife Ready CompleteCare provides you with coverage for 106 medical conditions for all stages of critical illnesses. An optional “cover me again” feature restarts your coverage up to 900% of your sum insured, even after you’ve made a claim.

Entry age: From age 0 to 65

Maximum coverage age: To age 75 or 99

Premium term/ payable: Yearly for the duration of the policy

| Manulife Ready CompleteCare (Product Details at a glance) | ||

| Cash value and Withdrawal benefit(s) | Yes | No |

|---|---|---|

| Policy cash value | X | |

| Surrender/ Maturity value | X | |

| Renewable/ Convertible features | X | |

| Health and Insurance coverage(s) | Yes | No |

| Death coverage | ||

| Terminal Illness coverage | X | |

| Total and Permanent Disability coverage | X | |

| Critical Illness coverage | ||

| Early Critical Illness coverage | ||

| Optional insurance rider(s) | Yes | No |

| Insurance riders to enhance coverage | X | |

| Additional product feature(s) | Yes | No |

| Cover me again benefit | ||

| Covers 106 conditions from all stages of critical illness | ||

| 100% refund of premiums in the event of death | ||

| Free health check-up every 2 years | ||

| Free coverage for your child under advanced stage critical illness | ||

| Covers recurring cancer | ||

Additional product feature(s) on Manulife Ready CompleteCare

Detailed features and unique selling points of Manulife Ready CompleteCare:

Cover me again benefit

- Your sum assured will be restored after 12 months from your last claim, if you choose to include the “cover me again” feature. This allows for multiple claims of up to 900% of your sum assured.

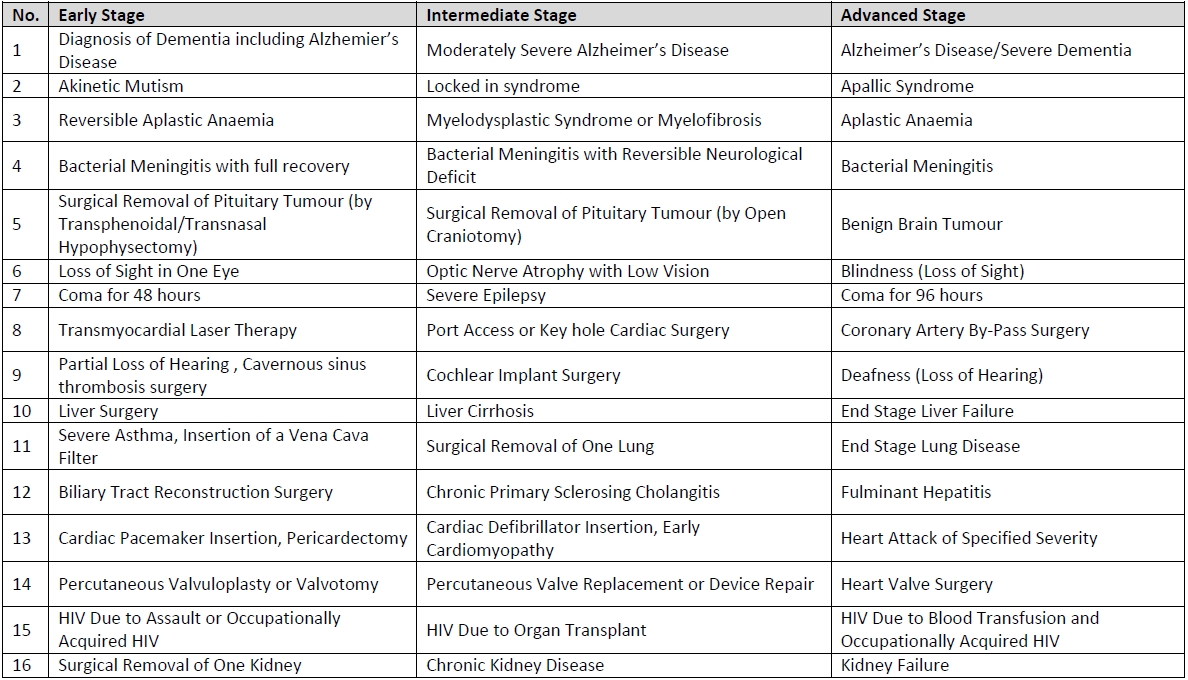

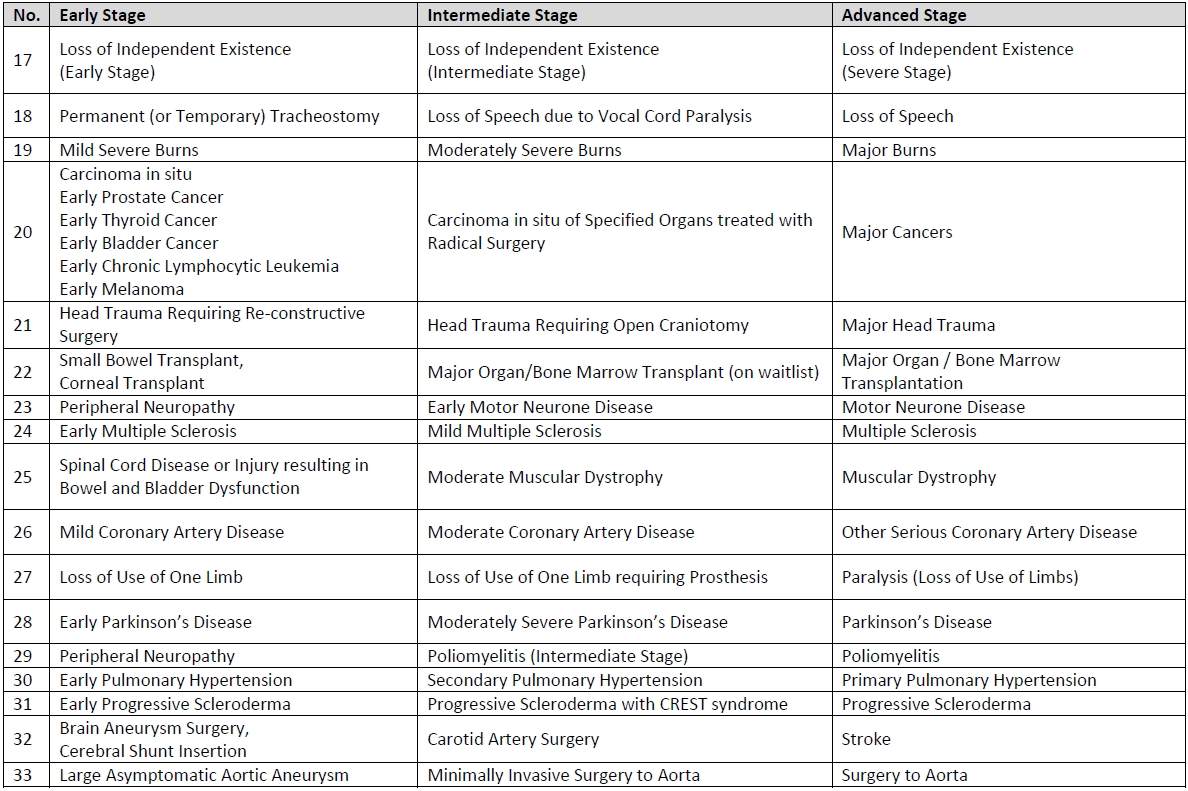

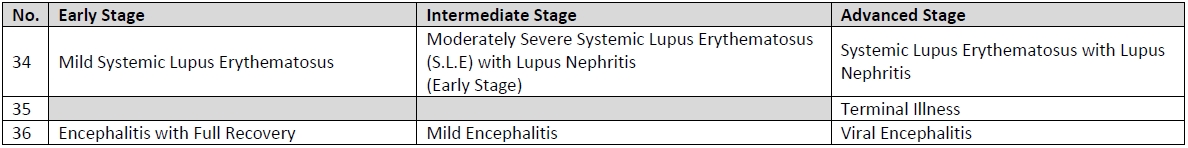

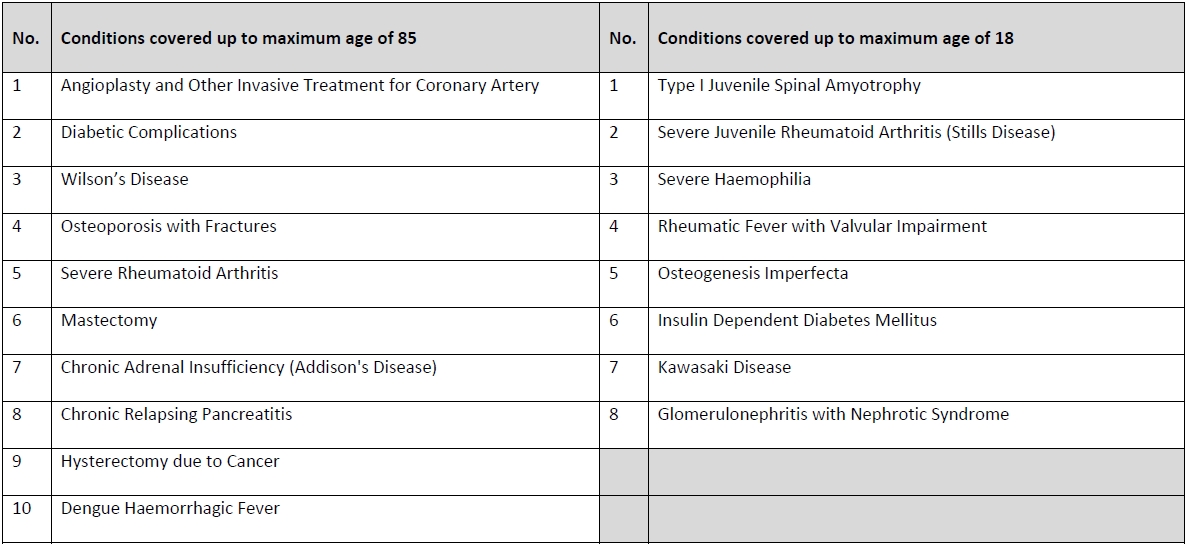

Covers 106 conditions from all stages of critical illness

- This critical illness plan covers you for up to 106 medical conditions and an additional 18 special conditions. Refer to the list of covered conditions below:

100% refund of premiums in the event of death

- In the event of death, 100% of the total premium paid less any claim made will be paid out

Free health check-up every 2 years

- Get a free health check every 2 years, transferable to your loved ones

Free coverage for your child under advanced stage critical illness

- In the event that your child is diagnosed with an advanced stage critical illness, the policy pays out a lump sum benefit of $10,000 per child. The maximum payout from the policy is $20,000.

Covers recurring cancer

Manulife Ready CompleteCare provides a recurring cancer benefit if the “cover me again” rider is taken up. The policy pays out 100% of the basic sum assured if you are diagnosed with any subsequent advanced stage major cancer after 2 years following any preceding major cancer claim. This claim will not reduce the current sum insured.

Who should take up a Manulife Ready CompleteCare?

Manulife Ready CompleteCare is a critical illness insurance plan. This category of insurance plans are suitable or unsuitable depending on the following factors:

Manulife Ready CompleteCare is suitable for

- Comprehensive coverage for early, intermediate and advanced stages of critical illnesses

- Supplement your existing coverage to provide financial support upon the diagnosis of early-stage critical illnesses

- High multiplied payout based on the sum assured value of the policy

Manulife Ready CompleteCare is not suitable for

- Wealth enhancement, wealth accumulation or cash value in your policy (Savings plans)

- High insurance payout in the event of death (Term plans, Whole life plans)

- Limited premium commitment as the insurance premium has to be paid yearly for the policy to stay in force

Sample policy illustration for Manulife Ready CompleteCare

Coming soon.

Learn more about Manulife Ready CompleteCare

Leave your personal details via the critical illness contact form to receive your personalised quote. You may also compare plans similar to Manulife Ready CompleteCare using the Critical Illness plan comparison portal.

Get your quote within 24 hours!

InsuranceFirst.sg compares and bring you the best 3 insurance quotes across all insurers in Singapore. Be it for your savings or protection needs, we got you covered!

Alternatively, contact us to know how this critical illness plan fits your insurance portfolio.