👍🏻 Best Whole Life Plans In Singapore 2021

These 4 whole life plans has been filtered by us to be the best, read on to find out why

In this article, we take a look at what are currently the best whole life plans in Singapore. Find out which one is best suited for you now.

In this article, we take a look at what are currently the best whole life plans in Singapore. Find out which one is best suited for you by reading on.

Before that, let’s briefly look at what is a whole life insurance plan.

A whole life plan gives you insurance protection and helps you save at the same time in the form of accumulating cash value in the policy. Effectively killing two birds with one stone!

There isn’t 1 best whole life plan to fit the needs of all. Different whole life plans offer different benefits that seek to solve the problems of different people.

There are dozens of whole life plans in the market offered by the 6 major insurance companies in Singapore. So what makes a great, or in this case, the best whole life plan? The best whole life plans in this article were filtered based on these key factors and their features:

- Limited pay premium term (pay for x number of years for lifetime coverage)

- Available riders to provide comprehensive coverage (option to be covered against Critical Illnesses of all stages, premium waivers, and so on.)

- Multiplier coverage benefit (receive a 2x, 3x, 4x, or 5x your base coverage up till a certain age)

With that in mind, we’ve filtered the following to be the best whole life plans for their different roles:

- Best Whole Life Plan for Whole Life Total and Permanent Disability Coverage – Aviva MyWholeLifePlan III

- Best Whole Life Plan for Comprehensive Coverage and Additional Benefits – Manulife LifeReady Plus

- Best Whole Life Plan for Future Disease Cover – NTUC Income Star Assure (formerly known as VivoLife)

- Best Whole Life Plan for Wide Range of Riders for Comprehensive Coverage – AXA Life Treasure

Best Whole Life Plan for Whole Life Total and Permanent Disability Coverage – Aviva MyWholeLifePlan III

Covering 132 critical illness of all stage, Aviva MyWholeLifePlan III provides the most comprehensive critical illness coverage with their Early Critical Illness Cover rider.

What you might look forward to:

- Flexible multiplier benefit of 2x, 3x, 4x or 5x up till age 65, 70, or 75

- Flexible premium terms of 10, 15, 20, 25 years

- Lifetime Total and Permanent Disability coverage for TPD rider

- Option to convert the cash value of the policy into 11-20 years of monthly income upon reaching age 65 onwards

- Early Critical Illness covers 132 critical illnesses and 32 special conditions

- Interest waivers on premium loans if you become retrenched

What you might not look forward to:

- TPD rider is not built-in and has to be added as a rider

- Retrenchment benefit only waives interests on premium loans, you still have to pay the premiums

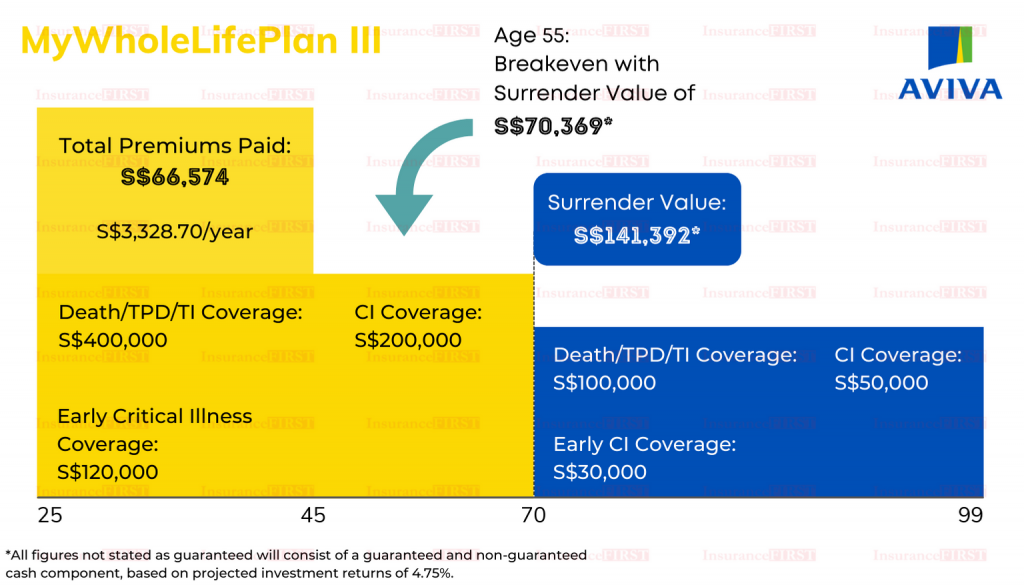

Aviva MyWholeLifePlan III Policy Illustration Breakdown

Jack, 25 years old, picked up Aviva MyWholeLifePlan III to cover himself. He chooses a base sum assured of S$100,000 for Death, Total and Permanent Disability, and Terminal Illness. S$30,000 for ECI, and S$50,000 for CI.

Jack chooses a multiplier benefit of 4X to increase his coverage up till age 70, giving him now S$400,000 against Death, TPD, and TI. S$120,000 against ECI, and S$200,000 against CI.

Choose a premium term of 20 years, Jack pays yearly premium of S$3,328.70 until age 45 with a total of S$66,574 paid in premiums.

Jack breaks even at age 55 with a total projected surrender value of S$70,369 (guaranteed and non-guaranteed bonuses)

At age 70, Johnny’s multiplier benefit comes to an end, reverting the coverage back to the base sum assured until age 99. His total projected surrender value at age 70 is at S$141,392 in which then he can choose to surrender the policy for cash or continue the policy to enjoy the coverage and benefits of the policy.

Best Whole Life Plan for Comprehensive Coverage and Additional Benefits – Manulife LifeReady Plus

With a great retrenchment benefit, you can rest assured that in the event you become retrenched, you would not have to worry a single bit about premium payment for 6 months. Your child also receives free critical illness coverage!

What you might look forward to:

- Flexible premium terms of 10, 15, 20, 25 or 99 years

- Low minimum sum assured starting from S$25,000

- Option to convert the cash value of the policy into 10 years of monthly income

- Premiums are waived for 6 months if you or your spouse becomes retrenched for 30 days

- Enjoy premium discounts on the first 2 years, continue receiving this benefit with proof of good health

- Early Critical Illness rider covers 125 Critical Illnesses of all stage and 18 Special Conditions

- Your child receives free critical illness coverage against 36 advanced-stage critical illness

- Option to increase your protection at key life milestones such as marriage, becoming a parent, etc. without proof of good health

What you might not look forward to:

- What’s there to not love with their fantastic free child cover and generous retrenchment benefit at the lowest premiums?

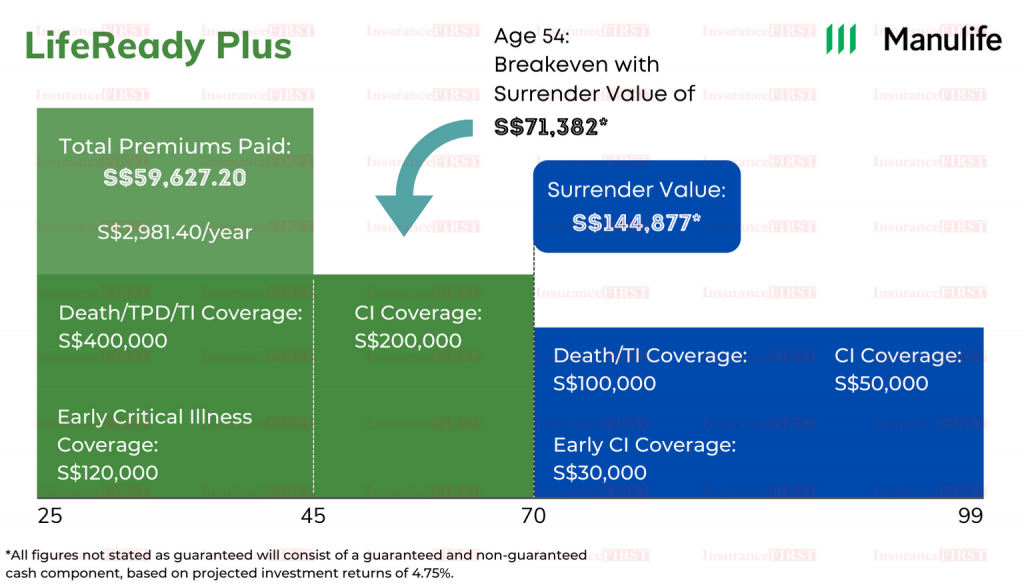

Manulife LifeReady Plus Policy Illustration Breakdown

Johnny, upon reaching the age of 25, decides to pick up Manulife LifeReady Plus to protect himself and his loved ones. He chooses a base sum assured of S$100,000 for Death, Total and Permanent Disability, and Terminal Illness. S$30,000 for ECI, and S$50,000 for CI.

Johnny then picks a multiplier benefit of 4X to increase his coverage up till age 70, giving him now S$400,000 against Death, TPD, and TI. S$120,000 against ECI, and S$200,000 against CI.

Choosing a premium term of 20 years, Johnny pays a yearly premium of S$2,981.40 until age 45 with a total of S$59,627.20 paid in premiums.

Johnny breaks even at age 54 with a total surrender value of S$71,382 (guaranteed and non-guaranteed bonuses)

At age 70, Johnny’s multiplier benefit comes to an end, reverting the coverage back to the base sum assured until age 99. His total projected surrender value at age 70 is S$144,877 in which then he can then choose to surrender the policy for cash or continue the policy to enjoy the coverage and benefits of the policy.

Best Whole Life Plan for Flexible Premiums Terms and Hospitalisation Benefit – NTUC Income Star Assure (formerly known as VivoLife)

Our homegrown insurer NTUC Income’s Star Assure has been chosen as the best for flexible premium term. Allowing you to pay premiums for 5 to 30 years in 5-year intervals or up till age 64.

What you might look forward to:

- Flexible premiums terms of 5, 10, 15, 20, 25, 30 years or up till age 64

- Receive double coverage against accidental death up till age 70

- Stop paying premiums for up to 6 months if you become retrenched

- Early Critical Illness rider covers you against 121 critical illnesses of all stages

- Critical Illness rider covers you against 39 advanced-stage critical illness and future unknown diseases such as COVID-19

- Receive daily cash benefit per day of hospitalisation

What you might not look forward to:

- Multiplier benefit ends at age 70, no other options

- No option to convert cash value into monthly retirement income

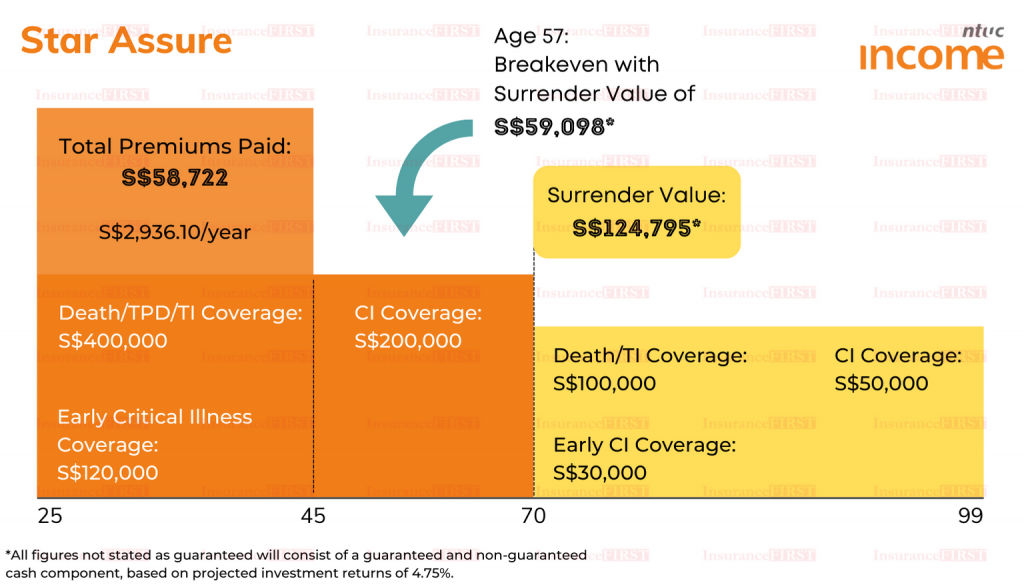

NTUC Income Star Assure Illustration Breakdown

Jane, upon reaching the age of 25, decides to pick up NTUC Income Star Assure to project herself and her loved ones. She chooses a base sum assured of S$100,000 for Death, Total and Permanent Disability, and Terminal Illness. S$30,000 for ECI, and S$50,000 for CI.

Jane picked a multiplier benefit of 4X to increase her coverage up till age 70, giving her now S$400,000 against Death, TPD, and TI. S$120,000 against ECI, and S$200,000 against CI.

Choosing a premium term of 20 years, Jane pays a yearly premium of S$2,936.10 per year until age 45 with a total of S$58,722 paid in premiums.

Jane breaks even at age 57 with a total projected surrender value of S$59,098 (guaranteed and non-guaranteed bonuses)

At age 70, Jane’s multiplier benefit comes to an end, reverting the coverage back to the base sum assured until age 99. Her total projected surrender value is at S$124,795 in which then she can choose to surrender the policy for cash or continue the policy to enjoy the coverage and benefits of the policy.

Best Whole Life Plan for Accidental Death Coverage – AXA Life Treasure

AXA Life Treasure provides a wide range of riders such as one that gives 14X the sum assured in the event of accidental death. The disability cash benefit rider gives you annual cash in the event you become totally and permanently disabled.

What you might look forward to:

- Flexible premium terms of 10, 15, 20, 25 or 30 years

- You can start covering yourself with a low base sum assured of S$25,000

- Early Critical Illness rider covers you against 132 critical illness of all stage and other juvenile and special conditions

- Critical Illness rider covers you against 40 advanced-stage critical illness

- Lump-sum disability payout in the event you are unable to perform 2 of 6 ADLs

- Receive up to 14X coverage against accidental death with an optional rider

What you might not look forward to:

- Premiums are higher than the other whole life plans listed in this article

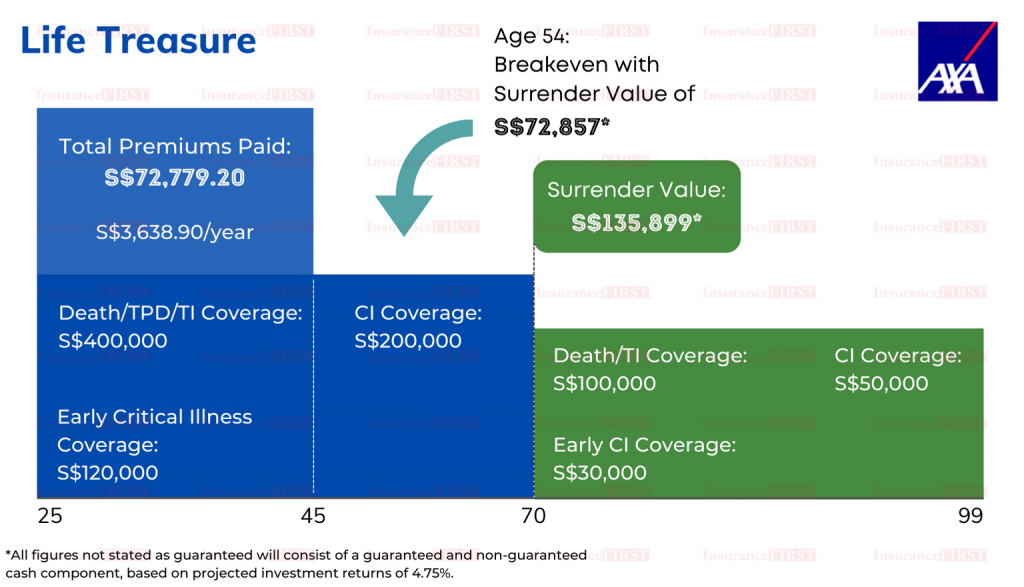

AXA Life Treasure Illustration Breakdown

Claire, upon reaching the age of 25, decides to pick up AXA Life Treasure to protect herself as well as her loved ones. She chooses a base sum assured of S$100,000 for Death, Total and Permanent Disability, and Terminal Illness. S$30,000 for ECI, and S$50,000 for CI.

Claire chooses a multiplier benefit of 4X to increase her coverage up till age 70, giving her now S$400,000 against Death, TPD, and TI. S$120,000 against ECI, and S$200,000 against CI.

Choose a premium term of 20 years, Claire pays a yearly premium of S$3,638.90 per year until age 45 with a total of S$72,779.20 paid in premiums.

Claire breaks even at age 54 with a total projected surrender value of S$72,857 (guaranteed and non-guaranteed bonuses)

At age 70, Claire’s multiplier benefit comes to an end, reverting the coverage back to the base sum assured until age 99. Her total projected surrender value is at S$135,899 in which then she can choose to surrender the policy for cash or continue the policy to enjoy the coverage and benefits of the policy.

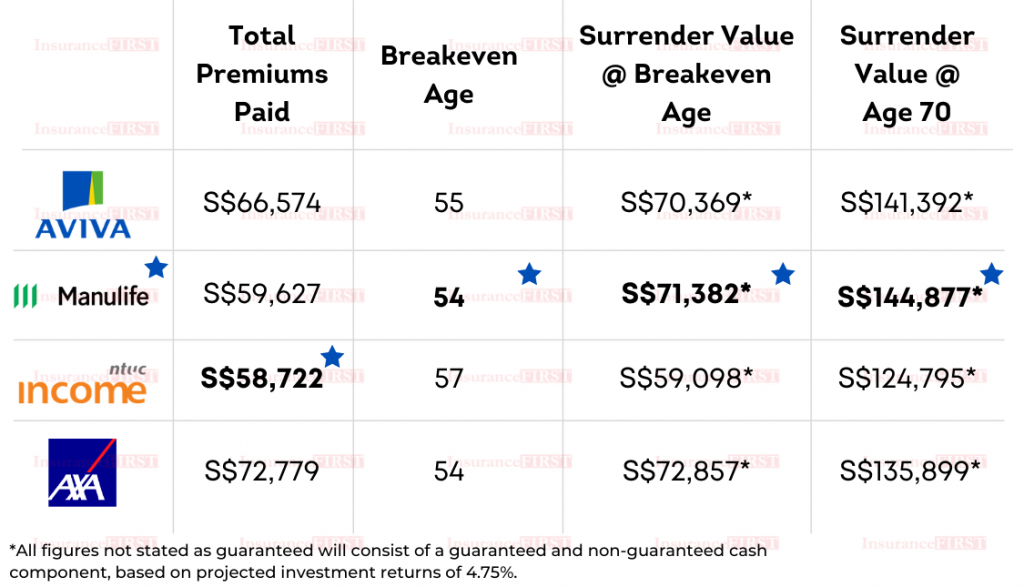

Best Whole Life Plans Comparison Table

For the same life and critical illness coverage, we have found that amongst our chosen best whole life plans:

- NTUC Income Star Assure is the best whole life plan for its affordability

- AXA Life Treasure and Manulife LifeReady Plus breaks even in the shortest period of time

- Manulife LifeReady Plus breakeven with the highest value (surrender value – premium paid)

- Manulife LifeReady Plus has the highest surrender value at age 70

Conclusion

There are many factors to consider when it comes to choosing a whole life plan as there is not a one size fit all option. If you are unsure, drop us your details and an experienced financial advisor will be in touch with you to guide you through everything.

Get your quote within 24 hours!

InsuranceFirst.sg compares and bring you the best 3 insurance quotes across all insurers in Singapore. Be it for your savings or protection needs, we got you covered!

Alternatively, drop us a message to know how a whole life insurance plan fits your financial portfolio.